-

While after-tax funds in employer-sponsored plans are tracked by plan administrators, clients are on their own with traditional IRAs, Jeffrey Levine writes.

June 4 -

"Many times it’s actually small, systematic behavioral changes in strategies that lead to sustainable, meaningful changes in outcomes," writes Michael Liersch.

June 4 Wells Fargo

Wells Fargo -

Almost nine in 10 estate planners say women clients either lost their jobs, had their salaries cut or left the workforce during the pandemic, a study shows.

June 3 -

When the millions left unemployed due to COVID-19 return to work, research suggests they will cash out of their former employers’ plans, Spencer Williams writes.

June 3 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

While the worries are all valid, they don’t mean the approach has suddenly become financial suicide overnight, writes Emily Cadman.

June 1 -

For accountants and tax professionals working with clients age 50 and older, there are certain tax perks to recommend that could help boost savings for the future.

May 26 Athene

Athene -

-

The Connecticut Democrat has introduced comprehensive legislation in each Congress since 2014. What are its prospects in this session?

May 19 -

Pulling the costs directly out of clients’ IRAs can blunt the sting, but it shrinks the pot of tax-deferred retirement assets.

May 18 -

Real interest rates, which protect from inflation, have fallen in recent years, making it more expensive to finance future spending, Allison Schrager writes.

May 14 -

The products have seen a 9% rise compared to the prior quarter, and a whopping 89% rise on year-ago levels, according to LIMRA data.

May 13 -

Women in the United States have a lot in common when it comes to managing their money. They prioritize financial stability and nearly half equate negative emotions with financial planning - far more than men.

-

-

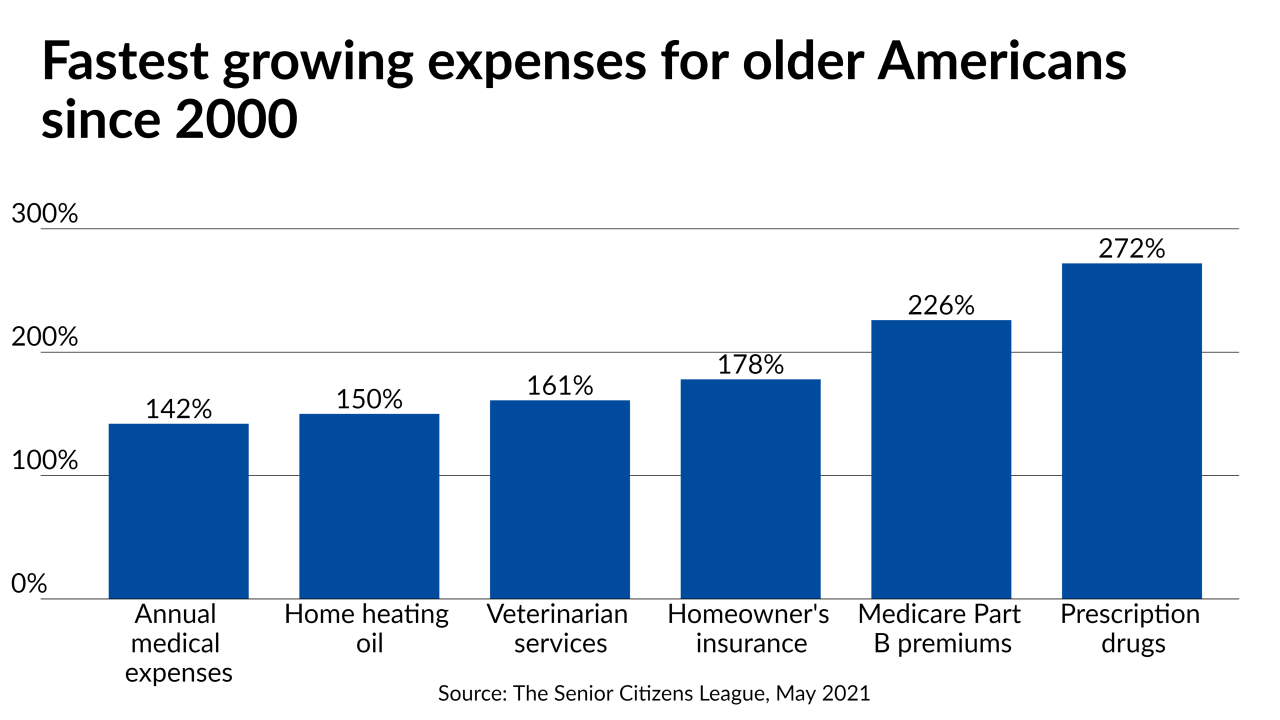

The Senior Citizens League made its forecast amid inflation fears and as advocates criticize the formula for calculating the annual adjustment.

May 12 -

Affluent clients can use wealth and retirement strategies to blunt the impact of the administration’s proposals, which include a higher capital gains rate.

May 11 -

Having had higher income in previous years may prevent a taxpayer from receiving a stimulus payment now, writes Jeffrey Levine.

May 6 -

DaRayl Davis used his clients' money to rent a fancy Hollywood mansion, purchase over $100,000 in airline tickets and pay off massive credit card bills.

May 5 -

The prospect of going back to the daily grind is going to be “a really tough pill for a lot of people to swallow,” an expert suggests.

April 30 -

The policy issues grow more urgent every year, but lawmakers haven’t passed any significant legislation for nearly 4 decades.

April 29 -

Even those who haven’t had a pay cut are revisiting the decision, with 22% tweaking the date, most aiming for a later exit, research shows.

April 23