A solid sixth man for the Milwaukee Bucks built his family's wealth after his playing days. Here's what financial advisors and investors can learn from his example.

-

Rich Guerrini said the bank plans to expand its advisor ranks by about 50% as it targets mass affluent and other new clients with personalized branch-based service.

-

The positive association between the largest certification in the planning profession and key client outcomes is adding to a growing field of research on the value of advice.

-

Having potential spouses on the same page regarding money before taking their vows can help stave off hurt feelings later.

-

Nearly two-thirds of advisors surveyed this month said that internal training programs or workshops were offered by their firms.

-

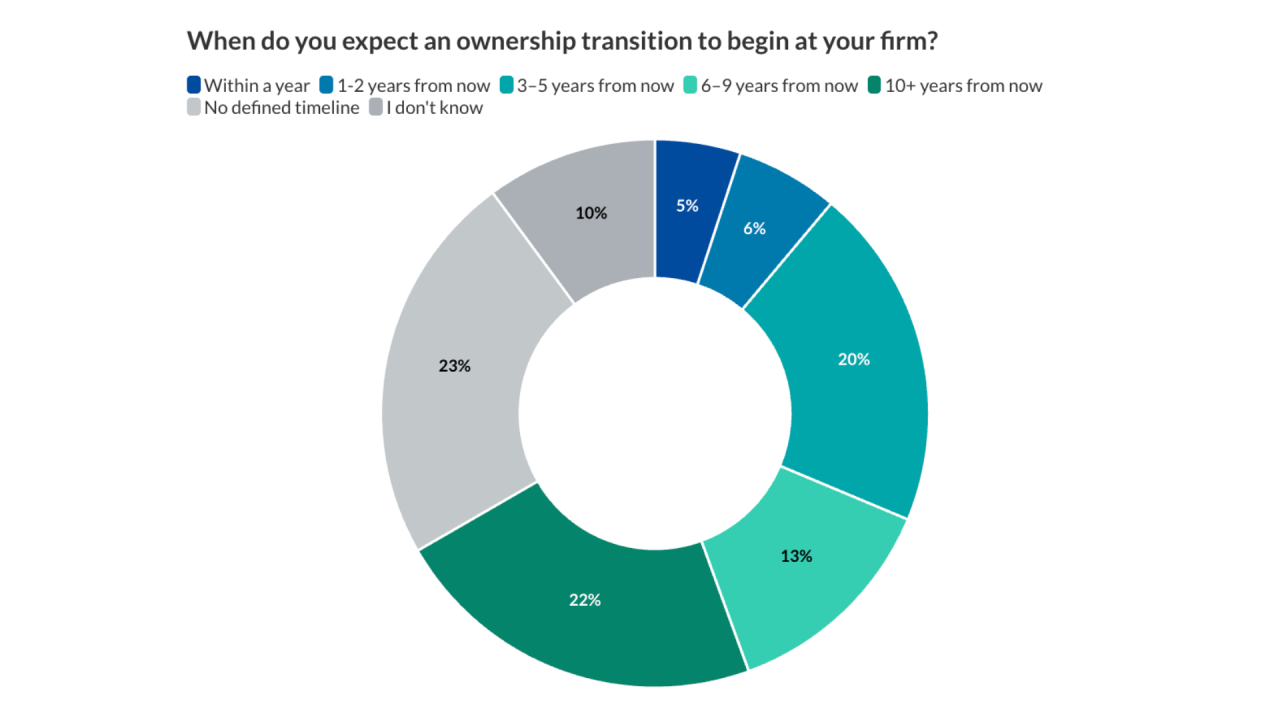

Many advisors haven't yet begun putting together an exit plan. Experts say there are common features and defined timelines that can help make it work.

-

A Financial Planning survey found that advisors believe AI will continue to transform wealth management. But experts say human oversight is still essential.

-

Across the industry, financial advisors are anticipating a busy 2026. From consumer protection cuts to AI regulation, wealth management could look very different a year from now.

-

- Tax TuesdayEvery TuesdayActionable ideas and savvy strategies advisors can use to guide their clients on tax matters. Delivered every Tuesday.

- RetirementEvery WednesdayAnalysis and strategies for all phases of retirement planning, including Social Security.

- DaybreakDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Best of the WeekWeeklyThe most popular stories of the week.

-

Default assumptions based on nonexistent children can lead to overaccumulation and unnecessarily delayed retirement.

-

Donor-advised funds should be temporary vessels, not permanent endowments. Here's how financial advisors can keep them from becoming philanthropic dead ends.

-

The tech can be smart and speedy, but also tone deaf when it comes to picking up the nuance of client conversations.

-

Experts say that there are pitfalls, rules and procedures that departing financial advisors should know. Problem is, too many act first and consult lawyers later.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

An annual RIA compensation survey suggests that firms are paying a pretty penny for financial advisors — but reaping healthy profits.

-

Financial Planning announces its 2026 class of the top 40 most productive employee wealth management brokers under the age of 40.

-

LeCount Davis, Stanley O'Neal, Maggie Lena Walker, June Middleton and Gerald B. Smith transformed wealth management, investment management and personal finance.

-

The annual ranking of the fee-only RIAs with the most assets under management — see the top firms.