Our monthly roundup of industry highlights

SEC requests comment on fund names rule

Fund names are often the first piece of information investors see, and they can have a significant impact on an investment decision, which is why the SEC requests public comment on its current requirements that restrict the use of potentially misleading fund names, according to the regulator.

The request seeks feedback on whether the current requirements are effective or if there are viable alternatives the SEC should consider. The request is the latest in the SEC's efforts to review existing rules to better inform investors.

"This request for comment is another important step in our efforts to better inform and protect Main Street investors and improve the investor experience," says SEC Chairman Jay Clayton. "We are looking to investors and market participants for input on how our framework can be improved to help ensure that fund names inform and do not mislead investors."

Gold volatility surges to most since 2008 on global market spasm

The CBOE Gold ETF Volatility Index, a measure of expectations for price swings tracked through ETF moves, has more than doubled over the past six sessions to the highest since November 2008, according to Bloomberg News.

Prices erased earlier gains following declines in U.S. stocks, as investors sold gold in a rush for cash to cover losses elsewhere, according to the article.

"Volatility remains the dominant scenario on markets, with gold proving no exception," said Carlo Alberto De Casa, chief analyst at ActivTrades, in an emailed note. "We are seeing a positive [direct] correlation between stock markets and gold, which should not be a big surprise, as every time there is a sharp market fall, many traders are using gold as their cash machine in order to keep other positions open that are being hit by margin calls."

BlackRock bond ETF plunge shows how traders can be spooked

A BlackRock ETF that invests in short-term bonds suffered an unprecedented plunge on speculation the firm was restricting cash redemptions, Bloomberg News reports.

The $6.2 billion iShares Short Maturity Bond ETF (NEAR), which primarily holds debt maturing in less than three years, fell as much as 8.9% — 34 times its biggest intraday drop in 2019, according to the article. It pared the decline late in the day as BlackRock paid out cash redemptions, closing down 6.2%, according to Bloomberg.

The ETF paid out about $150 million in redemptions, all in cash, according to BlackRock spokesman Ed Sweeney.

He said there were no in-kind redemptions. "Depending on market conditions, we assess all options to meet our clients' needs," he said. "In-kind redemptions are a feature of ETFs that can be used to facilitate redemptions and protect remaining fundholders."

Worst muni rout deepens even with Treasury gain

Municipal bond prices fell in the week ending March 18 as investors pulled funds out of the $3.9 trillion market, extending a nearly two-week slide that's put the market on pace for its steepest losses since 1984, according to Bloomberg News.

The municipal debt market has been battered by a liquidity crunch as fearful investors pull out their cash amid historic volatility. Investors continued to pull back from municipal-bond ETFs, with BlackRock's iShares National Muni Bond ETF (MUB) seeing a $132 million outflow, according to Bloomberg.

"Municipal bonds are supposed to be the safe asset," says Patrick Luby, who tracks the market for CreditSights. "You see this volatility, you see these losses, it can be very upsetting for someone looking at their nest egg."

BlackRock aims to hold directors accountable

BlackRock intends to step up efforts to hold corporate directors accountable for failure to improve corporate governance and sustainability practices, according to Bloomberg News.

BlackRock, which manages $7.4 trillion, published key indicators against which it will track companies' progress, and detailed the corporate directors it will vote against if no progress is demonstrated, according to the article.

The firm's priorities - board quality, environmental risks and opportunities, corporate strategy and capital allocation, compensation and human-capital management — will be "emphasized with greater vigor" this year, according to Michelle Edkins, the firm's global head of investment stewardship.

-

Fund managers may be better equipped to weather the market storm than their passive peers because of their ability to quickly cut risk.

March 9 -

Passive ETFs are often among the first to feel the pain of investors fleeing risky emerging markets for safer assets.

March 5 -

Your goal should be a visually compelling site with brief, concise content that immediately tells a visitor who you are, says marketing expert Dan Sondhelm.

March 30

3 steadfast REITs complete merger

Steadfast Apartment REIT, a public nonlisted REIT, completed mergers with Steadfast Income REIT and Steadfast Apartment REIT III, according to the firm. Following the move, the company now has approximately $3.4 billion in gross real estate asset value.

In exchange for each share of SIR and STAR III common stock, SIR and STAR III stockholders received 0.5934 and 1.43 shares, respectively, of STAR common stock, which is equivalent to $9.40 per SIR share and $22.65 per STAR III share, based on STAR's most recent estimated value per share of $15.84, according to the firm.

"We look forward to pursuing additional value creation opportunities as a robust company with increased cash flow and a strong balance sheet," says Ella Neyland, president of Steadfast Apartment REIT. "We are pleased that stockholders may participate in the potential benefits of a larger, stronger combined company."

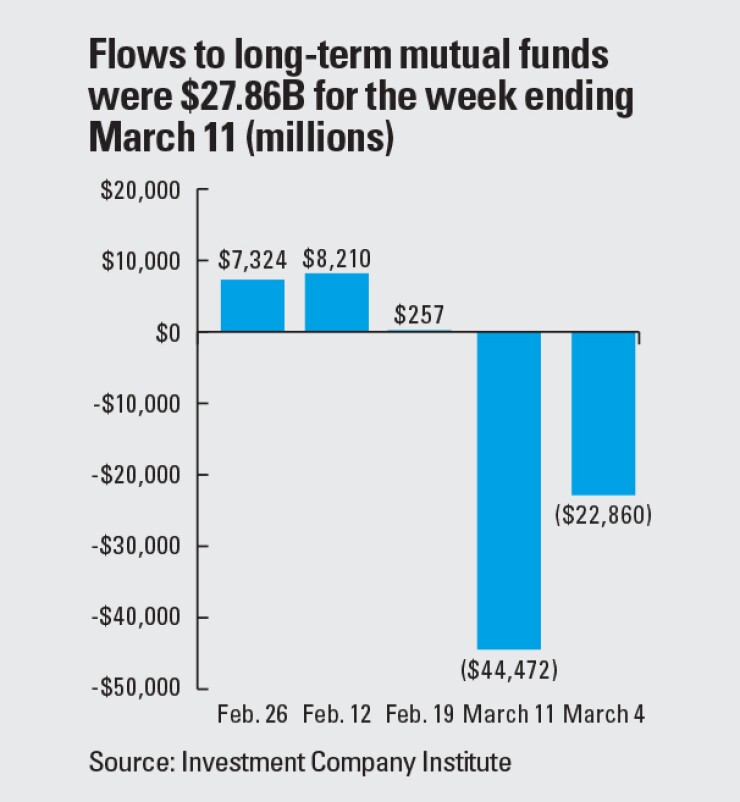

Investors pull $1.8 b from ETFs

The $4.4 trillion ETF industry saw outflows of more than $1.8 billion for the week ending March 13 for only the second time since October - led by fixed-income funds, according to Bloomberg News. This was a sharp reversal from the $16.3 billion inflows the previous week.

Stocks have whipsawed and Treasurys have surged despite dramatic moves from the Fed and other central banks. The $248 billion SPDR S&P 500 ETF Trust (SPY) plunged almost 12% after posting inflows of $9.2 billion.

State Street's Financial Select Sector SPDR fund (XLF) had its worst week of outflows since August, State Street's SPDR Gold Shares ETF (GLD) experienced outflows that were the worst since 2013 and BlackRock's iShares Core U.S. Aggregate Bond ETF (AGG) lost $3.1 billion, the worst since it began trading in 2003, according to Bloomberg News.

PRODUCTS

Schwab funds earn key role in $375M private college 529 plan

Charles Schwab announced its role in the $375 million conversion of Private College 529 Plan, a unique college savings program collectively owned by nearly 300 private colleges and universities nationwide, according to the firm.

Approximately 65% of the plan's portfolio — or $240 million — was invested in low-cost cap-weighted index funds managed by Charles Schwab Investment Management, according to the firm.

In addition, Charles Schwab Trust Bank has been named as custodian for all assets in the plan.

The funds are also some of the lowest-duration products in the market.

"We are so pleased to be part of a program that supports a key planning need for families in such a unique way," says Omar Aguilar, chief investment officer of passive equity and multi-asset strategies at CSIM. "Our goal is to support Private College 529 in its mission to make private college education more affordable."

BNP Paribas, Crown Holdings close sustainability credit facilities

BNP Paribas, a premier global bank, announced that it has helped Crown Holdings, which esigns, manufactures and sells packaging products and equipment for consumers, close its $3.3 billion sustainability-linked syndicated credit facilities, according to the firm.

BNP Paribas served as joint sustainability coordinator, working with Crown to integrate a sustainability feature into its credit facilities, according to the firm.

The announcement marks Crown as the first packaging company in the Americas to secure sustainability-linked terms for its syndicated credit facilities, and represents one of the largest sustainability-linked loans raised to date globally.

UBS to redeem two leveraged mortgage ETNs

UBS Group is mandatorily redeeming two leveraged ETNs tied to mortgage REITs, the firm said in a March 17 statement from the bank, according to Bloomberg.

The firm will redeem two series of the ETRACS Monthly Pay 2xLeveraged Mortgage REIT ETN, tickers MORL and MRRL, after the notes fell below a $5 minimum share value, according to the statement. The funds made leveraged bets on an index of mortgage REITs, and each had lost more than 95% of value last month.

-

Worries about the proliferation of new funds were high at the first Bogleheads conference without the company’s former leader.

October 30 -

"Asset managers need to be faster and smarter to make the right bets in a fast-changing external environment.”

March 6 -

Passive ETFs are often among the first to feel the pain of investors fleeing risky emerging markets for safer assets.

March 5

Duff & Phelps to redeem outstanding shares

Duff & Phelps Utility and Infrastructure Fund, a closed-end fund advised by Duff & Phelps Investment Management, announced it will redeem all of its outstanding Floating Rate Mandatory Redeemable Preferred Shares, Series A.

The fund is currently making the redemption as its voluntary option and part of what it says is prudent management of its use of leverage.

Eventide lowers fees on multi-asset income fund

Evetide Asset Management, the advisor to the Eventide Funds suite, announced plans to lower the fees for the Eventide Multi-Asset Income Fund. Following the move, the firm will reduce management fees to 60 basis points from 0.73%.

"We desire for our mission of promoting 'investing that makes the world rejoice' to be accessible to as many investors as possible," says Eventide CEO Robin John. "Our Multi-Asset Income Fund gives investors a great opportunity to invest alongside their values in a mixture of equities and bonds. Lowering the fees on this fund should make it more accessible to more investors."

Delta Data releases institutional profit, expense forecasting tool

Fintech company Delta Data announced the launch of an institutional profit and expense forecasting tool, IntelliCaster, designed to track multiple economic models to help asset manager distributors forecast everything from sales to fee data, according to the firm.

"We developed IntelliCaster to provide financial models that will aid in more realistic forecasting," according to Delta Data CEO Whitfield Athey.

"No one has a crystal ball," he adds. "However, with the major economic variables covered, any asset manager will be afforded a tighter picture of what profits against expenses should look like."

The platform, launched at the annual NICSA Strategic Leadership Forum in February, provides a way for asset managers to input macro-economic forecasts, which are then used as the basis for multiple scenarios that include adjustments from sales by region, dealer or product.

Once put in the system, IntelliCaster produces a forward-looking analysis of projected distribution fees, expenses and profit.

ARRIVALS

Black Diamond appoints head of private equity

The former managing director and co-head of The Carlyle Group's Carlyle Equity Opportunity Funds I and II Rodney Cohen has joined Black Diamond Capital as head of private equity, according to the firm.

Cohen will now be responsible for managing Black Diamond's portfolio of private equity funds, consisting of the BDCM Opportunity Funds II, III, IV and V, aggregating approximately $4 billion in capital, according to the firm.

"We are excited at the critical role [Rodney] will play in enabling our firm to continue to successfully identify and capitalize on opportunities in our investment platform," says Stephen Deckoff, Black Diamond's Managing Principal. "Rodney's proven track record, insight, and expertise make him a tremendous addition to our firm."

Cohen has previously served as co-chair of the investment committees of both funds and also served on the investment committees of Carlyle Global Partners, Carlyle Power Partners, and Carlyle Energy Mezzanine Fund I and II. Before that he was co-managing partner with Pegasus Capital Advisors, an investment firm with roughly $2 billion in AUM, the firm says. Before that he practiced law with Anderson, Kill, Olick & Oshinsky in New York.

Wave names president international

Former Pioneer Investments CEO Matteo Dante Perruccio has joined digital asset management firm Wave Financial in its newly created role of president international, according to the firm.

In this role, Perruccio is responsible for the international expansion of the firm and the development of relationships with its investor Fineqia International, a Toronto-listed cryptocurrency and blockchain technology investment company, according to Wave.

Perruccio will report to Wave CEO David Siemer.

"I am very excited about leveraging my financial services experience to help bridge the divide between traditional asset management and the fast-growing digital asset management sector," Perruccio says.

J.P. Morgan Asset Management adds global tactical asset allocation head

The former global head of credit and multisector strategies at Brandywine Global Gary Herbert has joined J.P. Morgan Asset Management as managing director and U.S. head of global tactical asset allocation for its multi-asset solutions business, according to the firm.

Herbet's sector oversees $265 billion in AUM, according to J.P Morgan.

During his 10 years at Brandywine, Herbert helped to build and implement a proprietary research process in order to improve macroeconomic, fundamental and quantitative research and decision-making.

Herbert will report to Jed Laskowitz, J.P. Morgan's global head of asset management solutions.

"Given the complexity of today's late cycle markets and increased client interest in tactical asset allocation, now is the right time to add Gary's deep knowledge and credit expertise to our team, to help clients build stronger portfolios," Laskowitz says.