After a record-breaking year for ETFs — with net inflows at around $450 billion — managers and industry experts expect a deeper focus on product innovation and fee reductions.

Smart beta growth, increased AUM, fee wars and more attention to risk-management strategies are key trends to watch, according to experts surveyed by Money Management Executive.

Vanguard's head of ETF product management, Rich Powers, looked at cost-saving strategies beyond low fees. "As expense ratios drop to the low single digits, an investor should consider looking beyond price alone," he wrote.

Maxwell Gold, director of investment strategy at ETF Securities, sees "new products focused on better downside protection, particularly as the current bull market continues to age and valuations remain stretched."

For other thoughts on what's ahead, we also solicited outlook from BlackRock's Head of U.S. iShares Martin Small; Reality Shares President and CEO Eric Ervin; Jennifer Muzerall, senior relationship manager, investor services, Brown Brothers Harriman; and David Dziekanski, portfolio manager at Toroso Investments.

Read on for their takes on what's ahead.

Vanguard ETF Product Manager Rich Powers: Lower costs expected

Fees are the most important factor when considering an ETF, according to an advisor survey from Cerulli Associates. Vanguard certainly agrees with that. Low costs are good for investors, who get to keep more of their gains.

Fortunately, fund costs are falling across the board. As expense ratios drop to the low single digits, managers should consider looking beyond price alone. If you're considering an investment with a fee of 0.80% vs. 0.10%, costs should be the top consideration. When differences in fees among competing products are only a few basis points, other factors may have a bigger relative impact.

Here are five other areas we believe investors are considering when selecting an ETF, especially those with similar benchmarks:

- Benchmark methodology. Seemingly small differences in benchmark methodology can yield different portfolio exposure. For example, Vanguard uses float-adjusted fixed-income benchmarks, which do not count bonds held by the Federal Reserve. Some asset managers do not use float-adjusted indexes.

- Tracking difference. A one-basis-point expense ratio advantage can be easily overwhelmed by mistracking a benchmark, when a fund manager fails to properly match the key characteristics of the fund's benchmark.

- Spreads. Bid-ask spreads are a cost of buying ETFs and can be materially larger than the expense ratio. Perform a total-cost-of-ownership comparison: the expense ratio plus the spread.

- Tax efficiency. Taxes can take a much bigger bite out of your clients' returns than expense ratios. Consider the frequency and magnitude of distributed capital gains and compare not only pre-tax returns but after-tax returns as well.

- The provider behind the product. ETFs are not run by a computer. Experience and expertise are needed to manage an ETF. Consider, too, if low costs are offered across the provider's product offerings.

Toroso Investments Portfolio Manager David Dziekanski: More ESG offerings

Last year was a record year for flows into ETFs, with inflows surpassing $450 billion. After huge flows to the smart beta space in 2016, 2017 was dominated by cheap beta products and high-active-share thematic products. We expect this trend will continue in 2018. Investors have shown a willingness to pay increased fees for something that is truly unique to the marketplace, with minimal broad overlap.

Another theme from 2017 that we expect will carry into 2018 will be increased focus on the ESG space. As recently as 26 months ago, there were only seven ESG offerings for the ETF realm. There are now 45 ESG offerings using an ETF wrapper, including offerings in the fixed-income arena, which are necessary for building an entire ESG ETF portfolio.

-

In price wars wars, the firm bolts ahead in the race to zero by nearly tripling its roster of commission-free funds.

October 19 -

The launch from EventShares provides investors access to economic and policy-driven themes.

October 20 -

Investors may be growing impatient with implementation of the administration’s agenda, an analyst says.

November 9

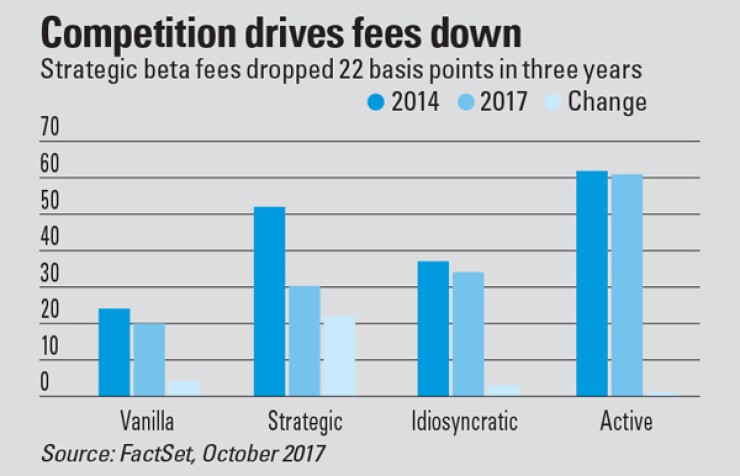

We expect smart beta funds that have significant overlap to broader indexes but still charge relatively high fees to lose ground to cheaper smart beta products.

Lastly, the cryptocurrency and blockchain space has caused a lot of buzz in the ETF world, with a significant number of filings ranging from long bitcoin, to short bitcoin, to long ethereum, to blockchain-related investments.

We expect to see the first of many ETFs launch in this space within the first few months of the year. We also anticipate ETFs flows will surpass those of mutual funds in 2018, as they did in 2017.

Reality Shares CEO Eric Ervin: A deeper focus on performance

While the bulk of asset flows have gone to incredibly low-cost, plain-vanilla index ETFs, a significant amount of assets have flowed and will continue to flow into smart beta ETFs, which offer many of the key benefits that active mutual fund managers attempt to deliver.

However, these funds manage to provide these benefits in a lower-cost, transparent, tax-efficient structure. The potential tidal wave of assets that will continue to flow from mutual funds is big (likely to be over $10 trillion).

ETFs bring choice, transparency and competition where consumers need it most. Active money managers have drifted more and more into closet benchmark huggers, and are now paying the price for their lack of alpha.

It is not all about cost, however. People will pay for alpha, but they will no longer accept high fees without performance that shows the funds are worth it.

Above all others, millennials are likely to include the funds in their portfolios, Schwab says.

Liquid alternative ETFs, thematic ETFs and fixed-income ETFs should continue to offer opportunities for investors with lower fees than their active mutual fund counterparts. But they are not free, and the market is willing to pay.

Boutique ETF issuers can carve out a comfortable niche by offering truly unique value-added products for those advisors looking to whittle down the cost structure of their mutual fund portfolios without sacrificing the individuality of their solutions.

Brown Brothers Harriman Senior Relationship Manager Jennifer Muzerall: An increase in smart beta

Although smart beta ETFs represent just over 20% of overall U.S. ETF assets, don't be surprised to see that percentage increase in 2018.

In a recent survey of professional ETF investors, BBH found that almost 30% plan to increase their exposure to smart beta ETFs over the next 12 months, as they get more comfortable with these strategies and see funds establish longer track records.

With fee wars still rampant among the providers of traditional low-cost ETFs, many ETF sponsors are launching smart beta products to differentiate themselves and earn higher fees for their investment expertise. This strategy may already be proving fruitful — 40% of investors surveyed who have purchased a smart beta ETF in the past 12 months did so through replacing index ETFs.

But another 35% of investors said they are using smart beta ETFs to replace active mutual funds. This could mean active managers that have not developed an ETF strategy are missing out on an opportunity to compete against low-cost passive strategies.

The two most common reasons cited by investors for not using smart beta ETFs were 1) not being able to determine if the strategies will generate alpha, and 2) general unfamiliarity with smart beta strategies and products. In order to keep smart beta momentum going, ETF sponsors must continue to increase awareness of smart beta and educate investors on its capabilities.

BlackRock Head of U.S. iShares Martin Small: Total assets to expand

ETFs had a breakout year in 2017. The question now is, can growth continue at this pace?

It can for a simple reason: investors aren't just buying more ETFs, they're using and benefiting from them in increasingly innovative ways.

The products are helping clients build better portfolios, target precise outcomes and participate in virtually every market imaginable — more precisely, simply, transparently and at a lower cost than ever before.

The ETF space has definitively moved beyond a set-it-and-forget-it broad market indexing approach. ETFs are now arming wealth managers with institutional-quality asset allocation tools that are knocking down the outdated barrier between active and passive strategies. This includes factor-based strategies, fixed-income ETFs, sectors and single countries, and new ways to seek income.

-

Advisors like the above-average returns and lower cost. But factor investing isn't risk free.

May 23 -

More than half of advisors would consider buying a smart beta muni bond ETF for clients, according to a Columbia Threadneedle poll.

September 6 -

Fundamental indexing is drawing more scrutiny, and greater concern about how these indexes are assembled.

July 13

Going forward, we expect to see even more strategies developed. We are indexing things today that we would not have thought possible just a decade ago. Major structural trends are likewise playing a part, notably the move to fee-based management, overall cost consciousness and the growing use of ETFs by alpha-seeking active managers. And with the rise of open, all-to-all networks, ETFs are taking their place alongside swaps, options and other derivatives as low-cost, convenient and transparent trading vehicles.

Collectively, we expect these forces to lead millions more investors into ETFs, potentially doubling global AUM by 2022. In short: ETFs are driving a movement, and the music isn't going to stop anytime soon.

ETF Securities Investment Strategy Director Maxwell Gold: Product innovation coming

At first glance, ETF product innovation may appear to be reaching maturity, with an ever-increasing number of funds and the emergence of a fee war among providers.

The current state of the ETF landscape, however, appears to be hitting a pivot point rather than a plateau. The first generation of ETFs focused on providing access to traditional markets and asset classes, followed by factor-based (smart beta) and active ETFs aimed at enhancing these exposures.

The next generation of ETF products will likely shift focus from providing line-item building blocks to building out a toolkit for portfolio management needs, particularly risk management and return enhancement.

On the risk management front, the first step (which is partly underway) will likely see new products focused on better downside protection, particularly as the current bull market continues to age and valuations remain stretched. Demand for options-based strategies, tail-risk hedging and portfolio insurance in ETF wrappers may see a boom in product innovation in coming years.

Continued expansion of ETF products anchored in non-traditional asset classes with low correlations for portfolio diversification needs will see more products tied to real assets, commodities and currencies.

On the return enhancement side, having already established effective solutions for providing beta exposure to equity, fixed-income and non-traditional markets, ETF product innovation will shift focus to providing solutions for alpha generation.

This will likely be in the form of further development of thematic-based (e.g., millennials, the next generation of commodities and automation), characteristic-based (spin-offs, IPOs and insider ownership) and alternative risk premia ETFs.

A key differing aspect these funds have compared to today's alpha-seeking ETFs, however, will be a strong emphasis on concentrated and pure-play exposures of the underlying asset. This will help drive higher tracking error, potential outperformance and product differentiation.