Three cheers for the SEC’s new Reg BI! Hip-hip —

OK, I know most of you have seen

If you missed it, the gist is that I believe that wirehouse lobbyists had a heavy hand in formulating the proposed disclosure language. As written, it would make reasonable people believe that brokers are acting at all times in their customers’ best interest. They would get that subtle hint from the fact that the SEC actually, in the proposal, renamed the suitability (sales) standard a “best interest” standard — without actually changing the obligations that a broker has to his or her customers.

It’s as if the SEC provided the brokerage and sales world with

So why am I cheering?

Because it looks like this time the SEC went too far, and I can see a fiduciary genie peeking out of the bottle. When the SEC ignored the ’40 Act and decided that brokerage firms could advertise as advisors, without being regulated as advisors, a lot of us winced, and the FPA

Big deal; nothing changed.

When brokerage firms sold cleverly packaged junk bonds to customers, and even invited hedge funds to design products that were destined to fail so they could bet against them, most of the free world winced, but the SEC seemed to regard the whole mess as business as usual.

After it was disclosed that the SEC enforcement staffers ignored a persistent whistleblower who had proof that

And so the most profitable business model in the financial services world — sales professionals posing as trusted advisors — continues to be the stinky center of gravity in the advisory world.

Clashes over the Labor Department's fiduciary rule have carried over into the debate on the SEC's proposed regulation.

The proposal so blatantly tipped the playing field in favor of the brokerage world that state regulators and a number of state legislators seem to have decided that they have no choice but totake matters in their own hands .

But after Reg BI, something changed. The proposal so blatantly tipped the playing field in favor of the brokerage world that state regulators and a number of state legislators seem to have decided that they have no choice but to

These regulators and legislators also noticed what the public seems to have missed: that in

The first two initiatives are coming from Nevada and New Jersey. Nevada’s draft regulation imposes fiduciary duties on financial planners — and manages to include brokers in the definition. On the surface, it seems pretty straightforward and logical: It says that a fiduciary duty would be imposed on a broker-dealer or sales rep whenever such entity or person provides investment advice, performs discretionary trading or maintains assets under management.

-

The policy had been under review after a federal appeals court vacated the fiduciary rule earlier this year.

August 30 -

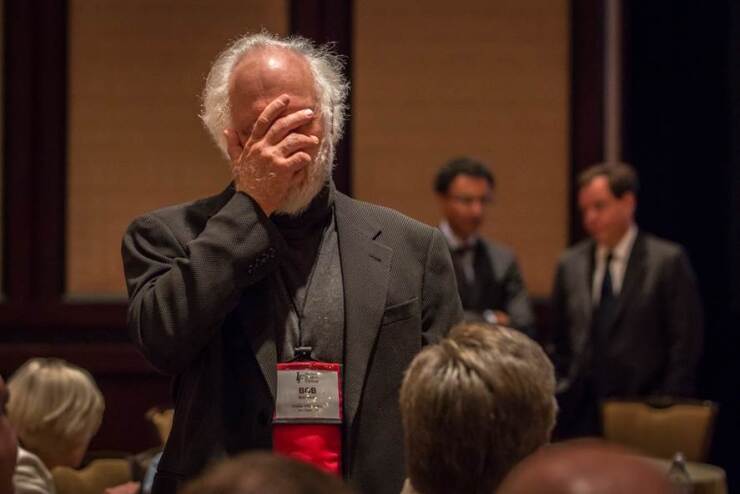

"The process has become enervating and exhausting and to the point where you don't even want to look at it anymore," an expert says.

August 9 -

An overreliance on disclosure isn't enough to protect clients from bad brokers, the investor advocacy group says.

August 7

Brokers and reps can avoid being required to treat their customers the way they would treat their grandmother if they don’t provide ongoing investment advice and don’t hold themselves out as an advisor, financial planner, financial consultant, retirement consultant or planner, wealth manager or counselor. (One hopes this applies to the advertisements by the parent company.)

The comment period just ended, and both SIFMA and FSI are arguing that fiduciary rules cannot be imposed because this would require their reps and brokers to maintain additional books and records — a violation of the provisions of the National Securities Market Improvement Act.

They are likely following the same lobbying path in New Jersey, where the state regulators and the state legislature are both considering “making it a dishonest or unethical business practice for failing to act in accordance with a fiduciary duty when recommending to a customer an investment strategy, or the purchase, sale or exchange of any security or securities, or providing investment advisory services to a customer.”

But … this is just two states, right? What kind of impact could it have if two states impose a fiduciary standard, while the SEC merrily puts its finger on the scales for the other 48?

There are two ways these individual state initiatives could change the game for consumers and salespeople in fiduciary clothing. First, if certain states required brokers to act as fiduciaries, the brokerage firms would have to amend their policies at a very deep level, not only for their brokers and reps operating in those states, but for anyone who might have a customer who moves to one of those states. They would also have to be careful with their national advertising campaigns. For instance, if they buy time during the Super Bowl to invite viewers to “consult with one of our financial advisors,” they instantly make all of their brokers have to live up to fiduciary standards in two states.

-

While the IBD advocacy organization supports the proposal’s approach, key questions loom over the timeline and makeup of the potential regulation.

September 26 -

Revenue from FIAs surged to well over the existing mark in the second quarter, while VAs stabilized after 17 straight quarterly declines.

August 24 -

Allianz became the second multinational insurance firm to step away from the IBD space this year under a plan to shutter Questar Capital.

October 11

Second, and perhaps more importantly, successful regulations in one state are often copied in others. They evolve into uniform rules that are then considered by all the other state legislatures — probably, in this case, first in the more liberal East Coast and West Coast states where consumer protections are taken more seriously, and later in states that will be embarrassed that they have failed to protect their citizens as rigorously as the people who live on the other side of the state border.

There are already some signs that the genie is emerging from the bottle. The New York State Department of Financial Services has proposed fiduciary standards regarding the sales of annuity and life insurance products. A new fiduciary bill has been introduced in Maryland’s state legislature. Will California be far behind?

I expect that the books and records argument will be swept aside by state regulators and lawmakers who are disgusted by the SEC’s weak regulatory hand — and that’s why I’m cheering the BI proposal. The SEC seems to have finally crossed a red line in the minds of people who are in a position to see the damage that sales-disguised-as-advice can do to the consumers they have sworn to protect.

And that also means that SIFMA’s and FSI’s last, most effective argument many also, finally, be swept aside: that the states should wait for the SEC to come out with its own proposal.

It did. It was a mess. It clearly exposed the SEC as a guardian of the brokerage business model rather than the consumer. Now the genie is emerging from the bottle, and the states are taking matters into their own hands.

Now everybody: Hip-hip —