-

The annual “evolution revolution” report and an analyst’s overview show how fiduciary advice is reshaping wealth management.

September 17 -

Some accuse index funds of promoting monopolies and distorting markets, among other horrors, but nothing has stemmed the wave of inflows to passive.

September 17 -

Narrowly focused investment strategies are a recipe for “feast or famine,” an analyst says.

September 11 -

Investment in technology and data management is becoming increasingly critical to distribution, and to managing regulation, reporting and operations.

September 8 -

The IBD trade group launched a public campaign after more than 80 cases this year alleging inadequate disclosure of mutual fund fees and compensation.

September 5 -

When pitted against the broader market, the top 20 outperformed both the Dow and S&P 500 by more than 5 percentage points.

September 4 -

The IBD failed to adequately disclose conflicts of interest to clients related to receiving $10.8 million from mutual funds and its clearing broker, the SEC says.

August 30 -

Nearly all bested the broader market at roughly a third the price of the average fixed income product.

August 17 -

As much as $18 billion of inflows to money market funds last week were partly driven by the desire to “take some chips off the table,” an expert says.

August 16 -

The simple addition of an exclamation mark to the names of some mutual funds led to significant declines in net flows, researchers find.

August 15 -

Here’s an analysis of six different funds that could be options for your retirement-income seeking clients.

August 13 -

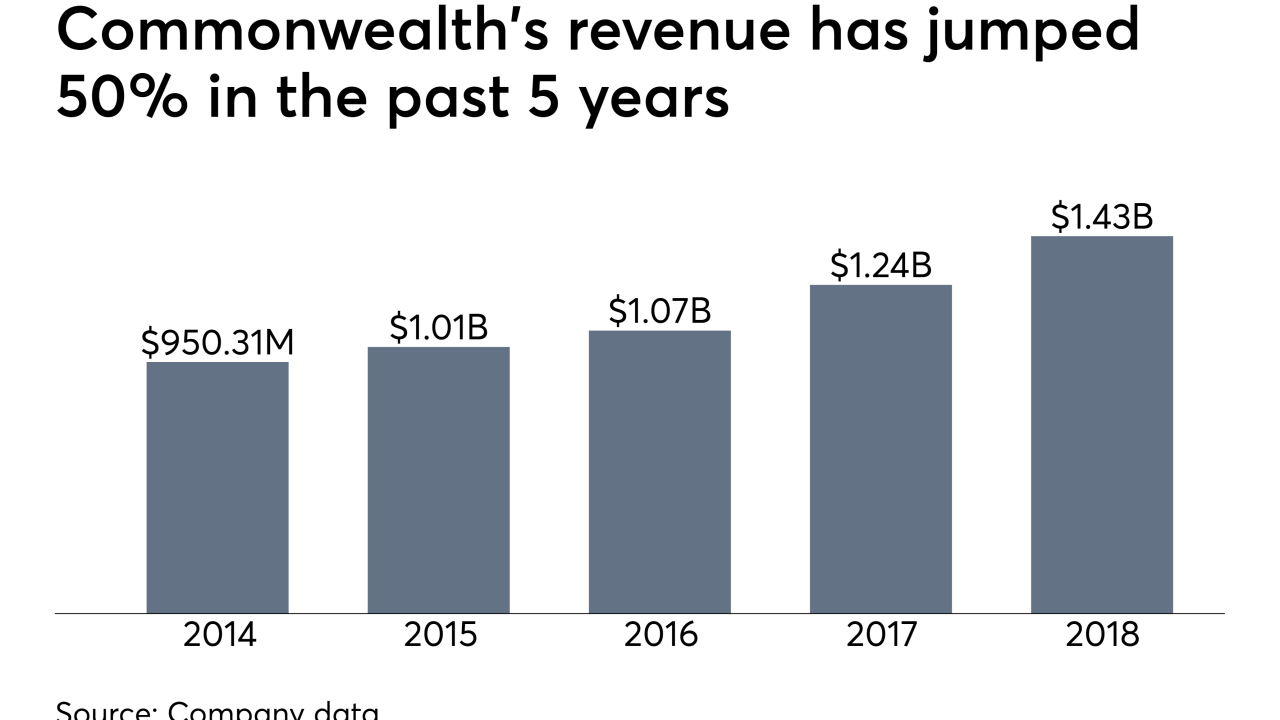

Critics reject the notion that disclosure alone is sufficient for reigning in conflicts — but the charges against Commonwealth have put BDs on notice.

August 12 -

Of the 25 new ETFs, the majority come from JPMorgan and investment company Direxion.

August 9 -

Although many underperformed the broader market, just over half posted double-digit gains.

August 7 -

The industry is embracing new technology, big data and alternative investment strategies as clients demand more from funds.

August 6 -

Data reported by the Investment Company Institute.

August 5 -

If approved, the actively managed product will hold anywhere from 60 to 100 equities across sectors and will have no position holding over 5%.

August 2 -

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

Some of the same features that led to their unpopularity may also be what uncorrelated them from their peers, an expert says.

July 31 -

On the surface, ETFs seem like a natural fit for ESG investors, but there’s an key difference between the two.

July 25