-

Data reported by the Investment Company Institute.

August 5 -

If approved, the actively managed product will hold anywhere from 60 to 100 equities across sectors and will have no position holding over 5%.

August 2 -

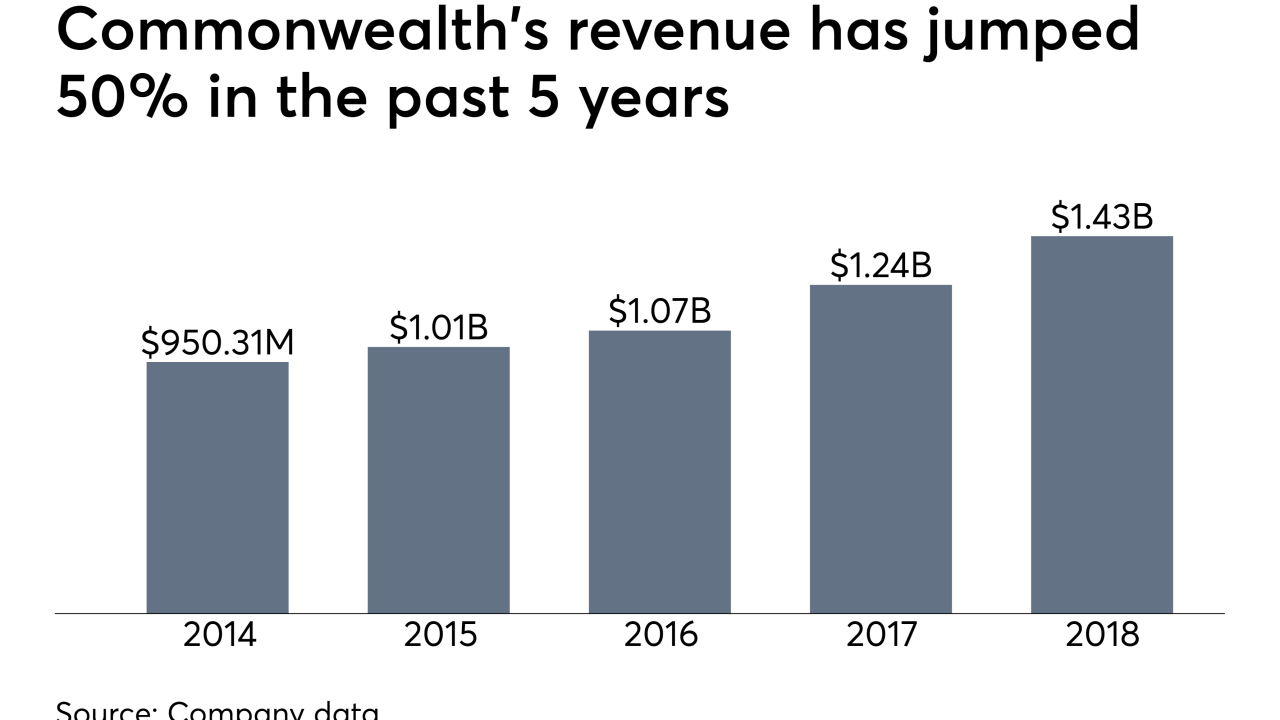

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

Some of the same features that led to their unpopularity may also be what uncorrelated them from their peers, an expert says.

July 31 -

On the surface, ETFs seem like a natural fit for ESG investors, but there’s an key difference between the two.

July 25 -

Fixed-income products designed to minimize interest rate risk are among the leaders.

July 24 -

Just five asset managers hold about 80% of the new money added to the municipal-bond market this year.

July 24 -

The correlation between fees and performance is not “apples-to-apples when taking the funds’ underlying exposures into account,” an expert says.

July 17 -

Expense ratios associated with the new products range from 0.05% to 0.07%.

July 16 -

The transition is expected to take place within the next 12 to 18 months, however the firm says it will still manage the products’ underlying investments.

July 16 -

The average expense ratio among the leading 20 is nearly 40 basis points cheaper than what investors paid on average last year.

July 10 -

Clients won't be taxed as the result of a deal if they hold the shares in ETFs or index mutual funds.

July 9 -

The custodial bank says it has reimbursed the affected clients with interest.

July 3 -

Though the fees are controversial, there may not be an easy way for the industry to abandon them.

June 19 -

Opening the door to retail money comes with risks, including the danger of exposing financial neophytes with relatively limited savings to complex investments.

June 18 -

The firm says it will focus the new funds on tech, demographics, urbanization, climate change and emerging global wealth.

June 17 -

Revisiting his predictions from 2017, he doubles down on the importance of firms adapting to embrace industry trends — and offers some new forecasts.

June 13

-

Advisors will find the lowest, near-zero fund. Do they read the fine print?

June 13 SEI Adviser Network

SEI Adviser Network -

Bonds were sold to build a development with a water park and Venice-style bridges. Now a Florida community is going bankrupt.

June 11 -

The firm expects shareholders will save an estimated $3.2 million, annually.

June 10